How much will IRFC be worth in 2025–2030? Check out expert forecasts, price targets, and predictions for IRFC based on technical analysis.

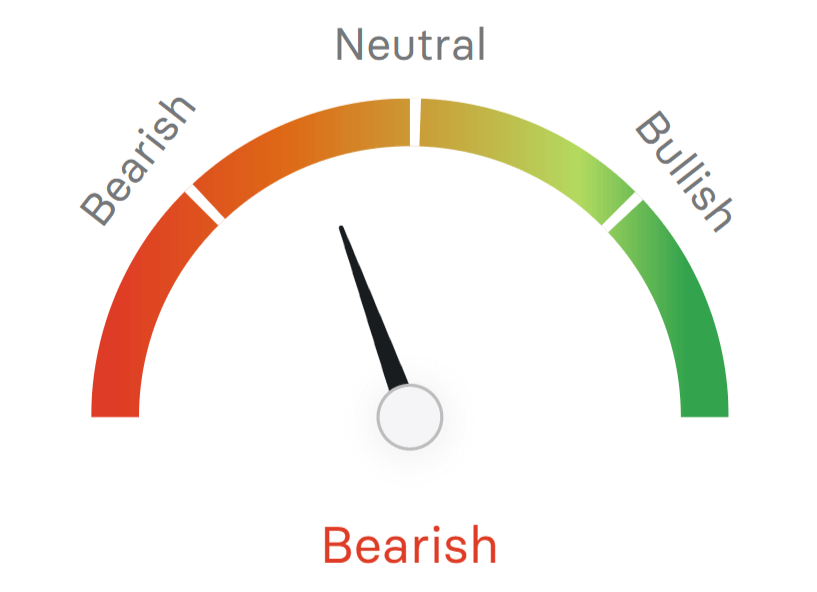

The current price of Indian Railway Finance Corporation (IRFC) on the NSE is ₹117.75. According to our forecast, the value of IRFC shares will rise by 72.67% and reach ₹203.32 per share by 2025. As per our technical indicators, the current sentiment is Bearish, while the Fear & Greed Index is showing a score of 38.98 (Fear). Currently, IRFC is trading below the 200-day simple moving average and the 50-day simple moving average, while the RSI is in the neutral zone (30-70). Based on the IRFC stock forecast, now is the bad time to buy IRFC shares.

IRFC Share Profit Calculator

IRFC Share Historical Stats

| Year | Avg. Price | Min. Price | Max. Price | Change |

|---|---|---|---|---|

| 2024 | ₹159.20 | ₹97.80 | ₹229.00 | 230.66% |

| 2023 | ₹48.15 | ₹25.40 | ₹104.10 | 108.37% |

| 2022 | ₹23.11 | ₹19.30 | ₹37.10 | -2.06% |

| 2021 | ₹23.59 | ₹20.80 | ₹26.70 | NA |

IRFC Share Price Target 2025

According to our latest price forecast produced and curated by a team of experienced analysts, IRFC share is expected to fluctuate between ₹129.36 and ₹203.32 in 2025. The average price target for IRFC share in 2025 is ₹167.50, which would be a 42.25% increase from the current price.

- At the beginning of 2025, the IRFC share price target could be around ₹142.84.

- By mid-2025, the price target might reach approximately ₹164.30.

- By the end of 2025, the price target for IRFC is expected to be around ₹203.32.

| Month | Price Target |

| January 2025 | ₹142.84 |

| February 2025 | ₹129.36 |

| March 2025 | ₹138.45 |

| April 2025 | ₹147.20 |

| May 2025 | ₹156.75 |

| June 2025 | ₹164.30 |

| July 2025 | ₹172.91 |

| August 2025 | ₹178.46 |

| September 2025 | ₹185.30 |

| October 2025 | ₹192.82 |

| November 2025 | ₹198.64 |

| December 2025 | ₹203.32 |

Read Also: RVNL Share Price Target & Forecast 2025–2030

IRFC Share Price Target 2026

After the analysis of the prices of IRFC share in previous years, it is estimated that in 2026, the minimum price of IRFC will be ₹208.45 while the maximum price may reach ₹268.20. On average, the trading price might be ₹239.60 in 2026, which is about 103.48% higher than current price.

- At the beginning of 2026, the IRFC share price target could be around ₹208.45.

- By mid-2026, the price target might reach approximately ₹238.30.

- By the end of 2026, the price target for IRFC is expected to be around ₹268.20.

| Month | Price Target |

| January 2026 | ₹208.45 |

| February 2026 | ₹215.30 |

| March 2026 | ₹212.74 |

| April 2026 | ₹224.40 |

| May 2026 | ₹232.66 |

| June 2026 | ₹238.30 |

| July 2026 | ₹245.76 |

| August 2026 | ₹252.90 |

| September 2026 | ₹258.44 |

| October 2026 | ₹255.80 |

| November 2026 | ₹262.65 |

| December 2026 | ₹268.20 |

Read Also: IRCON Share Price Target & Forecast 2025–2030

IRFC Share Price Target 2027

Figw Analysts estimate that the value of IRFC could reach a low of ₹275.60 and a high of around ₹342.30 by 2027. Overall, IRFC is expected to trade at an average price of ₹308.20 during the year.

- At the beginning of 2027, the IRFC share price target could be around ₹275.60.

- By mid-2027, the price target might reach approximately ₹302.90.

- By the end of 2027, the price target for IRFC is expected to be around ₹342.30.

| Month | Price Target |

| January 2027 | ₹275.60 |

| February 2027 | ₹282.40 |

| March 2027 | ₹278.75 |

| April 2027 | ₹288.31 |

| May 2027 | ₹294.65 |

| June 2027 | ₹302.90 |

| July 2027 | ₹314.44 |

| August 2027 | ₹322.81 |

| September 2027 | ₹331.35 |

| October 2027 | ₹328.89 |

| November 2027 | ₹335.64 |

| December 2027 | ₹342.30 |

Read Also: IRCTC Share Price Target & Forecast 2025–2030

IRFC Share Price Target 2028

According to our latest forecast for 2028, the lowest price target for IRFC is ₹338.75, while the highest is ₹425.90. On average, IRFC is expected to trade around ₹385.40.

- At the beginning of 2028, the IRFC share price target could be around ₹338.75.

- By mid-2028, the price target might reach approximately ₹386.76.

- By the end of 2028, the price target for IRFC is expected to be around ₹425.90.

| Month | Price Target |

| January 2028 | ₹338.75 |

| February 2028 | ₹345.90 |

| March 2028 | ₹354.30 |

| April 2028 | ₹362.85 |

| May 2028 | ₹372.40 |

| June 2028 | ₹386.76 |

| July 2028 | ₹395.29 |

| August 2028 | ₹402.90 |

| September 2028 | ₹408.45 |

| October 2028 | ₹412.81 |

| November 2028 | ₹418.34 |

| December 2028 | ₹425.90 |

IRFC Share Price Target 2029

According to our latest forecast for 2029, the lowest price target for IRFC is ₹442.45, while the highest is ₹548.80. On average, IRFC is expected to trade around ₹494.00.

- At the beginning of 2029, the IRFC share price target could be around ₹442.45.

- By mid-2029, the price target might reach approximately ₹494.89.

- By the end of 2029, the price target for IRFC is expected to be around ₹548.80.

| Month | Price Target |

| January 2029 | ₹442.45 |

| February 2029 | ₹451.30 |

| March 2029 | ₹468.74 |

| April 2029 | ₹478.40 |

| May 2029 | ₹485.65 |

| June 2029 | ₹494.89 |

| July 2029 | ₹502.45 |

| August 2029 | ₹498.80 |

| September 2029 | ₹508.36 |

| October 2029 | ₹515.91 |

| November 2029 | ₹532.44 |

| December 2029 | ₹548.80 |

IRFC Share Price Target 2030

According to our latest forecast for 2030, the lowest price target for IRFC is ₹555.90, while the highest is ₹678.80. On average, IRFC is expected to trade around ₹608.90.

- At the beginning of 2030, the IRFC share price target could be around ₹562.35.

- By mid-2030, the price target might reach approximately ₹588.90.

- By the end of 2030, the price target for IRFC is expected to be around ₹678.80.

| Month | Price Target |

| January 2030 | ₹562.35 |

| February 2030 | ₹555.90 |

| March 2030 | ₹569.44 |

| April 2030 | ₹584.80 |

| May 2030 | ₹591.36 |

| June 2030 | ₹588.90 |

| July 2030 | ₹605.44 |

| August 2030 | ₹622.81 |

| September 2030 | ₹639.35 |

| October 2030 | ₹645.88 |

| November 2030 | ₹662.46 |

| December 2030 | ₹678.80 |

IRFC Share Price Target from 2025 to 2030

Here is a table summarizing yearly price target of IRFC share from 2025 to 2030.

| Year | Price Target | Percent Increase |

| 2025 | ₹167.50 | 42.25% |

| 2026 | ₹239.60 | 103.48% |

| 2027 | ₹308.20 | 161.74% |

| 2028 | ₹385.40 | 227.3% |

| 2029 | ₹494.00 | 319.53% |

| 2030 | ₹608.90 | 417.11% |

IRFC Share Price Forecast Based on Technical Analysis

IRFC is currently in a Bearish trend according to different technical analysis indicators and moving averages, with a majority of indicators (1 Bullish, 13 Bearish, and 7 Neutral) supporting this outlook.

Moving averages and oscillators are popular tools to understand stock price trends and market behavior. SMAs and EMAs smooth out price fluctuations to identify trends over a certain amount of time. RSI and MACD are both momentum indicators that are used to identify stock momentum, overbought or oversold conditions and possible reversal points. In the tables below, you can find the values along with signals (bullish, bearish, neutral) for moving averages and oscillators.

Daily Simple Moving Average (SMA)

| Name | Value | Action |

|---|---|---|

| SMA (10) | 119.71 | Sell |

| SMA (20) | 123.84 | Sell |

| SMA (30) | 129.68 | Sell |

| SMA (50) | 135.47 | Sell |

| SMA (100) | 142.46 | Sell |

| SMA (200) | 159.84 | Sell |

Daily Exponential Moving Average (EMA)

| Name | Value | Action |

|---|---|---|

| EMA (10) | 118.86 | Sell |

| EMA (20) | 123.57 | Sell |

| EMA (30) | 127.37 | Sell |

| EMA (50) | 132.89 | Sell |

| EMA (100) | 141.37 | Sell |

| EMA (200) | 144.46 | Sell |

Daily Oscillators

| Name | Value | Action |

|---|---|---|

| Relative Strength Index (14) | 38.07 | Neutral |

| Stochastic %K (14, 3, 3) | 30.44 | Neutral |

| Commodity Channel Index (20) | −89.72 | Neutral |

| Average Directional Index (14) | 33.89 | Neutral |

| Momentum (10) | −1.54 | Buy |

| MACD Level (12, 26) | −6.10 | Sell |

| Stochastic RSI Fast (3, 3, 14, 14) | 48.26 | Neutral |

| Williams Percent Range (14) | −53.32 | Neutral |

| Ultimate Oscillator (7, 14, 28) | 41.44 | Neutral |

IRFC Latest News & Events Affecting Share Price

03/03/2025

IRFC stock has dropped around 51% from its 52-week high of ₹229. Analysts suggest that if it falls below ₹96, there may be more selling, and some experts recommend exiting the stock due to market volatility.

02/23/2025

IRFC Limited ₹7,500 crore term loan has been approved to finance NTPC Renewable Energy, which could increase investors interest.

02/20/2025

According to recent market analysis, IRFC shares have seen a rebound. Analysts suggest buying the stock on a positional basis, as the key support levels are around ₹120-121, and resistance can be seen between ₹130-132.

02/18/2025

IRFC shares have fallen 21% in a year and still remain bearish. Analysts are seeing chances of a bounce-back, but are also pointing out the risk of further decline.

02/10/2025

IRFC stock has fallen more than 75% from its peak and is now testing critical support levels. Analysts have given a sell target of ₹127 and are advising caution.

02/01/2025

IRFC shares initially rose on railway funding expectations but fell after the Union Budget did not bring the expected reforms, which caused market volatility.

IRFC Share Price Target FAQ

What is the IRFC share price target tomorrow?

IRFC share price target for tomorrow is between ₹116.44 and ₹121.19.

What is the IRFC share price target 2025?

IRFC share price target for 2025 is between ₹129.36 and ₹203.32.

What is the IRFC share price target 2030?

IRFC share price target for 2030 is between ₹555.90 and ₹678.80.

Is it profitable to invest in IRFC share?

According to our profit calculator, buying IRFC shares three years ago was a profitable decision, as the shares have increased by 446.40%.

What affects the price of IRFC share?

The price action of IRFC share is affected by supply and demand in the market. There are many things that affect supply and demand, such as a company’s financial performance (revenue, earnings, and future growth prospects), the overall economy (interest rates, inflation, and GDP growth), industry trends, investor sentiment, and news or events related to the company or its sector. And sometimes global events, political developments, and regulatory changes can also impact and influence share prices.

Risk Disclaimer: Stock prices can be volatile. You should only invest in stocks that you are familiar with and where you understand the associated risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be considered as financial advice. Past performance is not a reliable indicator of future performance. The value of your investment can go down as well as up, and you may not get back the amount you invested. You are solely responsible for your investment decisions. Figw is not responsible for any losses you may incur.