Suzlon Share Price Target 2025: On June 13, 2025, Geojit BNP Paribas downgraded its rating on Suzlon Energy (NSE: SUZLON) stock from ‘Buy’ to ‘Accumulate,’ with a price target of Rs 77 (previously Rs 71), which implies a potential upside of 19% from the current level.

Suzlon has an order book of over 5.5 GW, with 91% of orders linked to its S-144 turbines. Geojit expects WTG deliveries to grow at a 41% CAGR between FY25 and FY27, which has led to higher FY27 revenue and EBITDA estimates. This outlook is supported by stronger contribution margins in the WTG segment, which rose by 360 bps to 23% in FY25.

Despite challenges in execution, earnings are projected to grow at a 38% CAGR, and ROE is expected to reach 26%. The stock is valued at 38x FY27 EPS. While there have been delays in industry-wide commissioning, a sharp rise in activity during March and April helped offset part of the impact. Management expects that upcoming policy changes will support domestic manufacturing and improve execution.

As part of its growth plans, Suzlon has guided FY26 capex at Rs 400–450 crore, including Rs 225 crore for R&D. CRISIL upgraded the company’s credit rating to A/positive in FY25.

In other recent news, Suzlon’s promoters sold a 1.45% stake through a Rs 1,309 crore block deal, reducing promoter holding to 11.8%. The stake was acquired by Goldman Sachs, Morgan Stanley, mutual funds, and insurers. The stock rose 2% after the transaction. JM Financial issued a Buy rating with a revised target of Rs 81, based on projected EPS growth on hybrid renewables and import controls. After a sharp rally, the stock declined 8% in June.

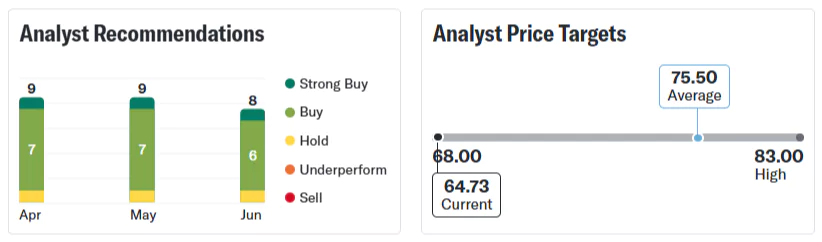

On Saturday at 12:00 PM, Suzlon share price was Rs 64.73, down 1.45% from the previous closing. A total of 90,283,546 shares of the stock traded hands, compared to its average volume of 86,356,536. The company has a market cap of Rs 899.397 billion and a PE ratio of 42.87.

Is Suzlon a Good Stock to Buy?

Turning to Wall Street, analysts have a “Buy” consensus rating on Suzlon stock. Based on S&P Global data, the average price target of Rs 75.50 implies an 16.64% upside from the current stock price. Over the past three months, out of 8 analysts covering the stock, 7 have issued Buy, 0 have assigned Sell, and 1 has given Hold, as shown in the graphic below.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on figw.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Figw or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.