Hindustan Zinc Share Price Target 2025 | June 19, 2025 – Hindustan Zinc share price is in the news today amid a broader market decline. Investors tracking Hindustan Zinc should know JM Financial has a “BUY” rating on the stock with a price target of Rs 550, around 21.47% above current levels.

Hindustan Zinc Share Price Today – Thursday June 19 2025

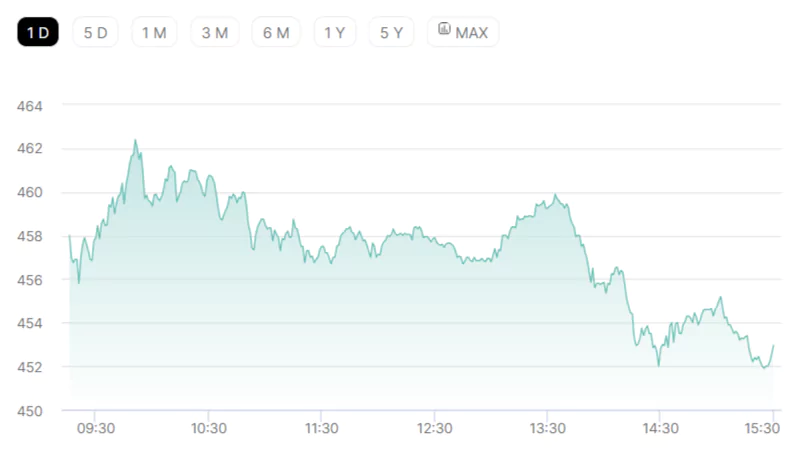

On Thursday, June 19, at 8:30 AM, Hindustan Zinc share price was Rs 452.80, down 6.90% from the previous closing. In comparison, the BSE Sensex was down 0.17% at 81,444.66. A total of 142,037,769 shares of the stock traded hands, compared to its average volume of 3,367,291. The company has a market cap of Rs 1.913 trillion and a PE ratio of 18.47.

Latest News about Hindustan Zinc

- Hindustan Zinc shares have dropped around 12–15% over the past week, closing near Rs 452–453 as of June 19, 2025. The decline followed a block deal where Vedanta sold a 1.6% stake for about Rs 3,028 crore.

- Hindustan Zinc declared an interim dividend of Rs 7 per share. The record date is June 24, 2025.

- The company’s board approved a Rs 12,000 crore capital expenditure plan to double production capacity. This includes 250,000 tonnes per annum of zinc smelting and 330,000 tonnes per annum of mining/milling, to be completed over the next three years in Rajasthan.

- CEO Arun Misra stated the expansion will be phased and remains on track regardless of global market uncertainties.

Company Financials

For the quarter ended March 31, 2025, Hindustan Zinc reported a Total Income of Rs 9,041 crore, down 5.67% from Rs 8,556 crore in the previous quarter. Compared to the same quarter last year, Total Income was up 19.75% from Rs 7,550 crore. The company reported a Net Profit of Rs 2,976 crore for the latest quarter.

As of March 31, 2025, Promoters held a 63.42% stake in the company. FIIs held 1.43%, and DIIs held 4.14%. Government held 27.92%, and the Public held 3.10% of the shares.

Hindustan Zinc Share Price Target 2025 – JM Financial

Hindustan Zinc announced a 250 kTPA integrated zinc metal complex at Debari, which will increase its total smelting capacity from 1,129 kTPA to 1,379 kTPA and 1,180 kTPA to 1,510 kTPA. This project will require CAPEX of approximately $120 billion, which will be deployed in FY26-28. The company revised its overall FY26 CAPEX guidance to USD 550 million.

The estimated cost of smelter installation is USD 2,500 per ton, which is below the global average of USD 3,500 per ton. This project is based on price assumptions of USD 2,650 per ton for zinc and USD 1,950 for lead and is expected to be completed in 36 months.

The report holds a positive outlook on Hindustan Zinc due to its position at the lower end of the global cost curve, full captive power coverage, and increasing share of revenue from silver sales. Hindustan Zinc| BUY – JM Financial

Hindustan Zinc Share Price Target 2025

Hindustan Zinc Share Price Overview

Hindustan Zinc Share Price Returns

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on figw.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Figw or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.