Tata Motors Share Price Target 2025: How much will Tata Motors be worth in 2025–2030? Check out expert forecasts, price targets, and predictions for Tata Motors based on fundamental analysis.

Key Takeaways

- As of June 29 2025, Tata Motors shares are trading at ₹686.90 on the NSE.

- Based on our analysis, the price target of Tata Motors stock in 2025 can be around ₹880.

- Tata Motors may reach a price target of ₹1,710 in 2030.

Latest News about Tata Motors

- Tata Motors will demerge its commercial and passenger vehicle businesses into separate listed companies, which is expected to be completed by Q4 2025.

- The company plans to invest ₹35,000 crore by 2030 to launch 30 new vehicles, covering both electric and internal combustion engine models, including the Sierra and Avinya.

- The Tata Harrier EV has been launched in India with a claimed range of up to 622 km. Bookings for the rear-wheel-drive variant will open on July 2.

- BNP Paribas has rated Tata Motors as “Outperform” with a target price of ₹830, based on its strong free cash flow yield compared to other Indian auto OEMs.

About Tata Motors Ltd (TATAMOTORS)

Tata Motors is India’s largest commercial vehicle manufacturer and ranks third in the domestic passenger vehicle market with a share of around 13–14%. It leads the Indian electric vehicle (EV) segment, with EVs accounting for about 60–73% of its total electric vehicle sales. The company operates in three main segments: Jaguar Land Rover (JLR), Commercial Vehicles (CV), and Passenger Vehicles (PV).

Jaguar Land Rover contributes nearly 70% of Tata Motors’ revenue. In the most recent quarter, JLR posted a profit before tax of £875 million, its highest in over a decade. The Commercial Vehicles segment had revenue of ₹21,485 crore and an EBIT margin of 9.7%. The passenger vehicles segment reported lower revenue and a modest EBIT margin of 1.6%, though EV models like the Nexon and Punch continue to perform well.

Tata Motors’ EV business reported a positive EBITDA margin for the first time in FY25. The company ended the fiscal year with positive net automotive debt, effectively becoming net cash positive. It has also announced a ₹6 per share final dividend for FY25.

Tata Motors Share Price Target 2025 by months

This forecast is based on the month-by-month price trends over the past 12 months.

| Period | Price Target |

| July 2025 | ₹715 |

| August 2025 | ₹740 |

| September 2025 | ₹775 |

| October 2025 | ₹810 |

| November 2025 | ₹845 |

| December 2025 | ₹880 |

Tata Motors Share Price Target 2025 to 2030

This forecast is based on historical price trends, long-term development prospects, and industry trends.

| Year | Price Target | Change % |

| 2025 | ₹880 | 28.15% |

| 2026 | ₹1,020 | 48.54% |

| 2027 | ₹1,180 | 71.83% |

| 2028 | ₹1,340 | 95.15% |

| 2029 | ₹1,515 | 120.56% |

| 2030 | ₹1,710 | 148.97% |

Tata Motors Share Price Target 2025: Analyst Recommendations

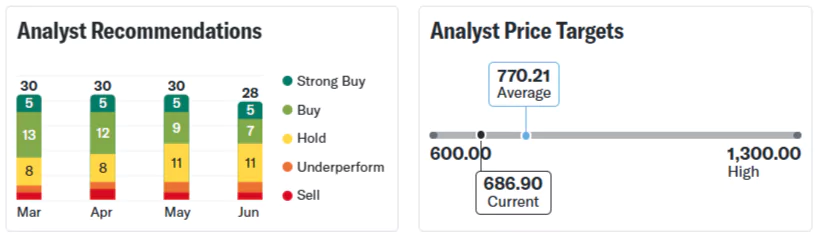

Turning to Wall Street, analysts have a “Buy” consensus rating on Tata Motors stock. Based on S&P Global data, the average price target of Rs 770.21 implies an 12.13% upside from the current stock price. Over the past three months, out of 28 analysts covering the stock, 12 have issued Buy, 5 have assigned Sell, and 11 have given Hold, as shown in the graphic below.

Revenue and Earning Estimate

| Year | Revenue | EPS |

| 2025 | ₹4.52T | ₹55.38 |

| 2026 | ₹4.92T | ₹67.25 |

| 2027 | ₹5.28T | ₹81.08 |

| 2028 | ₹5.43T | ₹94.00 |

Recent Analyst Forecasts and Stock Ratings

| Date | Brokerage | Price Target | Upside % |

| 18 Jun 2025 | Emkay | ₹750 | 9.18% |

| 17 Jun 2025 | ICICI Securities | ₹775 | 12.79% |

| 17 Jun 2025 | JM Financial | ₹705 | 2.63% |

| 17 Jun 2025 | Edelweiss Securities | ₹670 | -2.46% |

| 17 Jun 2025 | Motilal Oswal | ₹690 | 0.45% |

Historical Performance

Financial Performance

Peer Comparison

Shareholding Pattern

Tata Motors Share Price Target FAQ

What is the Tata Motors share price target 2025?

The share price target for Tata Motors Ltd (TATAMOTORS) for 2025 is ₹880.

What is the Tata Motors share price target 2030?

The share price target for Tata Motors for 2030 is ₹1,710.

Is Tata Motors a good stock to buy?

Yes. Out of 28 analysts covering Tata Motors in the last three months, 12 have given a Buy rating, 11 has given a Hold rating, and 5 have recommended a Sell. The overall consensus is “Hold.”

What affects the price of Tata Motors share?

The price action of Tata Motors share is affected by supply and demand in the market. There are many things that affect supply and demand, such as a company’s financial performance (revenue, earnings, and future growth prospects), the overall economy (interest rates, inflation, and GDP growth), industry trends, investor sentiment, and news or events related to the company or its sector. And sometimes global events, political developments, and regulatory changes can also impact and influence share prices.

How to Buy Tata Motors Share?

You can buy Tata Motors shares using a trading and demat account with top brokers like Zerodha, Groww, Angel One, ICICI Direct, HDFC Securities, or Kotak Securities by placing an order on NSE or BSE.

Risk Disclaimer: Stock prices can be volatile. You should only invest in stocks that you are familiar with and where you understand the associated risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be considered as financial advice. Past performance is not a reliable indicator of future performance. The value of your investment can go down as well as up, and you may not get back the amount you invested. You are solely responsible for your investment decisions. FIGW is not responsible for any losses you may incur.