Adani Power Share Price Target 2025: How much will Adani Power be worth in 2025–2030? Check out expert forecasts, price targets, and predictions for Adani Power based on fundamental analysis.

Key Takeaways

- As of June 30 2025, Adani Power shares are trading at ₹588 on the NSE.

- Based on our analysis, the price target of Adani Power stock in 2025 can be around ₹680.

- Adani Power may reach a price target of ₹1,210 in 2030.

Latest News about Adani Power

- Adani Power shares rose over 14% in the past week, trading around ₹605 on the BSE, with strong volumes and bullish technical indicators.

- Adani Power received $384 million from Bangladesh for power dues in H1 2025, after waiving $20 million in late fees. Total collections so far amount to approximately $1.5 billion out of $2 billion billed.

- At the 2025 AGM, Adani Group announced that Adani Power has generated over 100 billion units of electricity and aims to reach 31 GW thermal capacity by 2030.

- Adani Power awarded BHEL a ₹6,500 crore contract for six 800 MW thermal units, leading to a 3% increase in BHEL’s share price.

About Adani Power Ltd (ADANIPOWER)

Adani Power Limited (APL) is a subsidiary of the Adani Group and is the largest private thermal power producer in India. The company operates a total installed capacity of 17,550 MW across 12 assets and plans to expand it to 30,670 MW by 2030, the largest planned expansion by any private power company in the country. APL has placed advance orders for 11.2 GW of ultra-supercritical boilers, turbines and generators to support this growth.

In FY25, APL reported total revenue of ₹56,203 crore and power sales of 95.9 billion units, an increase of over 20% year-on-year. Installed capacity grew by 15% over the previous year and plant load factor improved to nearly 65%. Net profit for the year was ₹12,939 crore. Net debt stood at ₹26,095 crore, with a debt-to-equity ratio of around 0.5 times.

APL is expanding through both acquisitions and new projects. It has long-term power purchase agreements in several states. The company also participates in the merchant power market, where Q4 FY25 volumes grew 19%, although average tariffs declined during the period.

Adani Power Share Price Target 2025 by months

This forecast is based on the month-by-month price trends over the past 12 months.

| Period | Price Target |

| July 2025 | ₹604 |

| August 2025 | ₹618 |

| September 2025 | ₹635 |

| October 2025 | ₹648 |

| November 2025 | ₹662 |

| December 2025 | ₹680 |

Adani Power Share Price Target 2025 to 2030

This forecast is based on historical price trends, long-term development prospects, and industry trends.

| Year | Price Target | Change % |

| 2025 | ₹680 | 15.65% |

| 2026 | ₹755 | 28.23% |

| 2027 | ₹848 | 44.22% |

| 2028 | ₹950 | 61.73% |

| 2029 | ₹1,070 | 81.97% |

| 2030 | ₹1,210 | 105.78% |

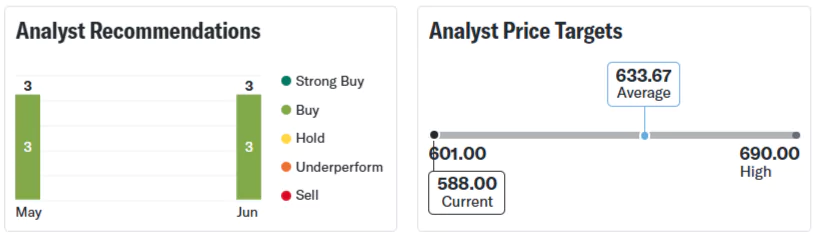

Adani Power Share Price Target 2025: Analyst Recommendations

Turning to Wall Street, analysts have a “Buy” consensus rating on Adani Power stock. Based on S&P Global data, the average price target of Rs 633.67 implies an 7.77% upside from the current stock price. Over the past three months, out of 3 analysts covering the stock, 3 have issued Buy, 0 have assigned Sell, and 0 have given Hold, as shown in the graphic below.

Revenue and Earning Estimate

| Year | Revenue | EPS |

| 2025 | ₹625.51B | ₹38.16 |

| 2026 | ₹667.76B | ₹40.72 |

| 2027 | ₹799.07B | ₹45.05 |

| 2028 | ₹927.35B | ₹59.20 |

Recent Analyst Forecasts and Stock Ratings

| Date | Brokerage | Price Target | Upside % |

| 21 May 2025 | Asit C Mehta Financial Services | ₹680 | 15.65% |

| 19 Feb 2025 | Ventura | ₹806 | 37.07% |

Historical Performance

Financial Performance

Peer Comparison

Shareholding Pattern

Adani Power Share Price Target FAQ

What is the Adani Power share price target 2025?

The share price target for Adani Power Ltd (ADANIPOWER) for 2025 is ₹680.

What is the Adani Power share price target 2030?

The share price target for Adani Power for 2030 is ₹1,210.

Is Adani Power a good stock to buy?

Yes. Out of 3 analysts covering Adani Power in the last three months, 3 have given a Buy rating, 0 have given a Hold rating, and 0 have recommended a Sell. The overall consensus is “Buy.”

What affects the price of Adani Power share?

The price action of Adani Power share is affected by supply and demand in the market. There are many things that affect supply and demand, such as a company’s financial performance (revenue, earnings, and future growth prospects), the overall economy (interest rates, inflation, and GDP growth), industry trends, investor sentiment, and news or events related to the company or its sector. And sometimes global events, political developments, and regulatory changes can also impact and influence share prices.

How to Buy Adani Power Share?

You can buy Adani Power shares using a trading and demat account with top brokers like Zerodha, Groww, Angel One, ICICI Direct, HDFC Securities, or Kotak Securities by placing an order on NSE or BSE.

Risk Disclaimer: Stock prices can be volatile. You should only invest in stocks that you are familiar with and where you understand the associated risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be considered as financial advice. Past performance is not a reliable indicator of future performance. The value of your investment can go down as well as up, and you may not get back the amount you invested. You are solely responsible for your investment decisions. FIGW is not responsible for any losses you may incur.