How much will Jio Financial Services be worth in 2025–2030? Check out expert forecasts, price targets, and predictions for Jio Financial Services based on technical analysis.

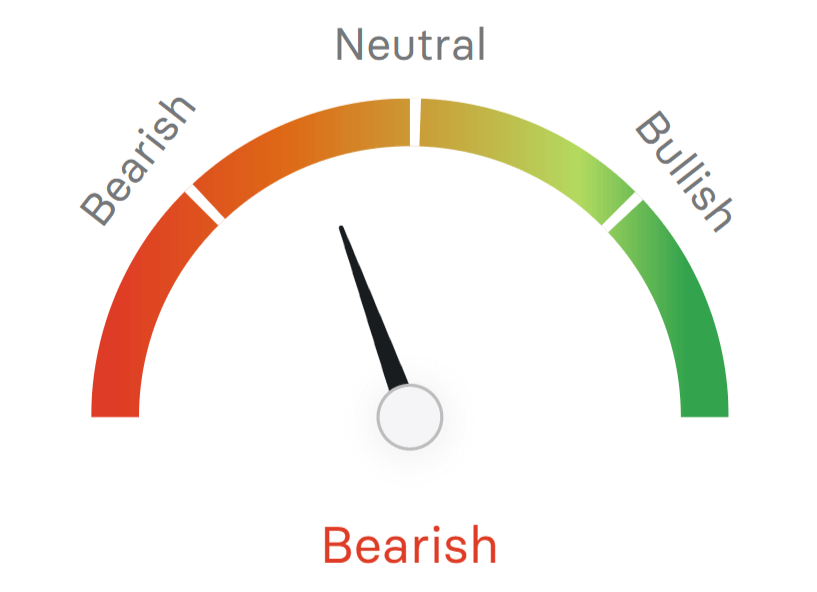

The current price of Jio Financial Services (JIOFIN) on the NSE is ₹222.25. According to our forecast, the value of Jio Financial Services shares will rise by 49.27% and reach ₹331.75 per share by 2025. As per our technical indicators, the current sentiment is Bearish, while the Fear & Greed Index is showing a score of 49.61 (Fear). Currently, Jio Financial Services is trading below the 200-day simple moving average and the 50-day simple moving average, while the RSI is in the neutral zone (30-70). Based on the Jio Financial Services stock forecast, now is the bad time to buy Jio Financial Services shares.

Jio Financial Services Share Profit Calculator

Jio Financial Services Share Historical Stats

| Year | Avg. Price | Min. Price | Max. Price | Change |

|---|---|---|---|---|

| 2024 | ₹328.28 | ₹232.00 | ₹394.70 | 43.29% |

| 2023 | ₹229.10 | ₹202.80 | ₹266.95 | NA |

Jio Financial Services Share Price Target 2025

According to our latest price forecast produced and curated by a team of experienced analysts, Jio Financial Services share is expected to fluctuate between ₹208.50 and ₹331.75 in 2025. The average price target for Jio Financial Services share in 2025 is ₹250.00, which would be a 12.49% increase from the current price.

- At the beginning of 2025, the Jio Financial Services share price target could be around ₹241.65.

- By mid-2025, the price target might reach approximately ₹224.50.

- By the end of 2025, the price target for Jio Financial Services is expected to be around ₹331.75.

| Month | Price Target |

| January 2025 | ₹241.65 |

| February 2025 | ₹208.60 |

| March 2025 | ₹212.40 |

| April 2025 | ₹215.20 |

| May 2025 | ₹208.50 |

| June 2025 | ₹224.50 |

| July 2025 | ₹238.10 |

| August 2025 | ₹263.75 |

| September 2025 | ₹259.30 |

| October 2025 | ₹279.30 |

| November 2025 | ₹311.75 |

| December 2025 | ₹331.75 |

Read Also: Reliance Industries Share Price Target & Forecast 2025–2030

Jio Financial Services Share Price Target 2026

After the analysis of the prices of Jio Financial Services share in previous years, it is estimated that in 2026, the minimum price of Jio Financial Services will be ₹282.40 while the maximum price may reach ₹419.85. On average, the trading price might be ₹330.80 in 2026, which is about 48.84% higher than current price.

- At the beginning of 2026, the Jio Financial Services share price target could be around ₹315.60.

- By mid-2026, the price target might reach approximately ₹306.40.

- By the end of 2026, the price target for Jio Financial Services is expected to be around ₹419.85.

| Month | Price Target |

| January 2026 | ₹315.60 |

| February 2026 | ₹283.80 |

| March 2026 | ₹282.40 |

| April 2026 | ₹294.10 |

| May 2026 | ₹286.85 |

| June 2026 | ₹306.40 |

| July 2026 | ₹323.20 |

| August 2026 | ₹349.10 |

| September 2026 | ₹344.35 |

| October 2026 | ₹365.25 |

| November 2026 | ₹398.50 |

| December 2026 | ₹419.85 |

Jio Financial Services Share Price Target 2027

Figw Analysts estimate that the value of Jio Financial Services could reach a low of ₹366.50 and a high of around ₹514.75 by 2027. Overall, Jio Financial Services is expected to trade at an average price of ₹418.10 during the year.

- At the beginning of 2027, the Jio Financial Services share price target could be around ₹402.80.

- By mid-2027, the price target might reach approximately ₹390.30.

- By the end of 2027, the price target for Jio Financial Services is expected to be around ₹514.75.

| Month | Price Target |

| January 2027 | ₹402.80 |

| February 2027 | ₹368.90 |

| March 2027 | ₹366.50 |

| April 2027 | ₹378.60 |

| May 2027 | ₹370.75 |

| June 2027 | ₹390.30 |

| July 2027 | ₹408.55 |

| August 2027 | ₹437.10 |

| September 2027 | ₹433.50 |

| October 2027 | ₹454.75 |

| November 2027 | ₹490.30 |

| December 2027 | ₹514.75 |

Jio Financial Services Share Price Target 2028

According to our latest forecast for 2028, the lowest price target for Jio Financial Services is ₹460.55, while the highest is ₹617.85. On average, Jio Financial Services is expected to trade around ₹515.25.

- At the beginning of 2028, the Jio Financial Services share price target could be around ₹499.80.

- By mid-2028, the price target might reach approximately ₹485.90.

- By the end of 2028, the price target for Jio Financial Services is expected to be around ₹617.85.

| Month | Price Target |

| January 2028 | ₹499.80 |

| February 2028 | ₹463.15 |

| March 2028 | ₹460.55 |

| April 2028 | ₹474.80 |

| May 2028 | ₹466.50 |

| June 2028 | ₹485.90 |

| July 2028 | ₹505.10 |

| August 2028 | ₹534.75 |

| September 2028 | ₹530.20 |

| October 2028 | ₹554.45 |

| November 2028 | ₹589.90 |

| December 2028 | ₹617.85 |

Jio Financial Services Share Price Target 2029

According to our latest forecast for 2029, the lowest price target for Jio Financial Services is ₹565.10, while the highest is ₹739.60. On average, Jio Financial Services is expected to trade around ₹624.35.

- At the beginning of 2029, the Jio Financial Services share price target could be around ₹604.50.

- By mid-2029, the price target might reach approximately ₹591.60.

- By the end of 2029, the price target for Jio Financial Services is expected to be around ₹739.60.

| Month | Price Target |

| January 2029 | ₹604.50 |

| February 2029 | ₹567.30 |

| March 2029 | ₹565.10 |

| April 2029 | ₹579.85 |

| May 2029 | ₹572.25 |

| June 2029 | ₹591.60 |

| July 2029 | ₹611.85 |

| August 2029 | ₹644.90 |

| September 2029 | ₹640.10 |

| October 2029 | ₹666.85 |

| November 2029 | ₹708.10 |

| December 2029 | ₹739.60 |

Jio Financial Services Share Price Target 2030

According to our latest forecast for 2030, the lowest price target for Jio Financial Services is ₹687.00, while the highest is ₹850.75. On average, Jio Financial Services is expected to trade around ₹750.00.

- At the beginning of 2030, the Jio Financial Services share price target could be around ₹725.40.

- By mid-2030, the price target might reach approximately ₹717.90.

- By the end of 2030, the price target for Jio Financial Services is expected to be around ₹850.75.

| Month | Price Target |

| January 2030 | ₹725.40 |

| February 2030 | ₹689.30 |

| March 2030 | ₹687.00 |

| April 2030 | ₹702.85 |

| May 2030 | ₹696.75 |

| June 2030 | ₹717.90 |

| July 2030 | ₹739.75 |

| August 2030 | ₹775.40 |

| September 2030 | ₹770.80 |

| October 2030 | ₹803.10 |

| November 2030 | ₹837.50 |

| December 2030 | ₹850.75 |

Jio Financial Services Share Price Target from 2025 to 2030

Here is a table summarizing yearly price target of Jio Financial Services share from 2025 to 2030.

| Year | Price Target | Percent Increase |

| 2025 | ₹250.00 | 12.49% |

| 2026 | ₹330.80 | 48.84% |

| 2027 | ₹418.10 | 88.12% |

| 2028 | ₹515.25 | 131.83% |

| 2029 | ₹624.35 | 180.92% |

| 2030 | ₹750.00 | 237.46% |

Jio Financial Services Share Price Forecast for 1 year: What do Analysts Predict?

In this section, you will learn the following analyst Forecast:

- Predicted share price

- Annual revenue Forecast.

- Annual earnings per share (EPS) Forecast.

The Forecasts are made based on surveys of various financial institutions, brokerage firms, fund managers, and independent analysts, and are sourced from S&P Global Market Intelligence.

| Analyst Recommendations (2 Analysts) | |

| Buy | 0.00% |

| Hold | 100.00% |

| Sell | 0.00% |

| Overall Recommendation | Hold |

| Share Price Forecast for 1 year | |

| Current Share Price | ₹222.25 |

| Minimum Forecast | ₹286.00 |

| Maximum Forecast | ₹347.00 |

| Average Forecast | ₹316.50 |

| Annual Revenue Forecast | |

| 2024 | ₹20.00B |

| 2025 | ₹24.40B |

| 2026 | ₹32.30B |

| Annual earnings per share (EPS) Forecast | |

| 2024 | ₹2.50 |

| 2025 | ₹3.00 |

| 2026 | ₹4.00 |

Jio Financial Services Share Price Forecast Based on Technical Analysis

Jio Financial Services is currently in a Bearish trend according to different technical analysis indicators and moving averages, with a majority of indicators (5 Bullish, 9 Bearish, and 7 Neutral) supporting this outlook.

Moving averages and oscillators are popular tools to understand stock price trends and market behavior. SMAs and EMAs smooth out price fluctuations to identify trends over a certain amount of time. RSI and MACD are both momentum indicators that are used to identify stock momentum, overbought or oversold conditions and possible reversal points. In the tables below, you can find the values along with signals (bullish, bearish, neutral) for moving averages and oscillators.

Daily Simple Moving Average (SMA)

| Name | Value | Action |

|---|---|---|

| SMA (10) | 215.60 | Buy |

| SMA (20) | 221.20 | Buy |

| SMA (30) | 228.09 | Sell |

| SMA (50) | 244.40 | Sell |

| SMA (100) | 282.73 | Sell |

| SMA (200) | 312.54 | Sell |

Daily Exponential Moving Average (EMA)

| Name | Value | Action |

|---|---|---|

| EMA (10) | 220.15 | Buy |

| EMA (20) | 223.96 | Sell |

| EMA (30) | 230.47 | Sell |

| EMA (50) | 244.66 | Sell |

| EMA (100) | 270.81 | Sell |

| EMA (200) | 287.74 | Sell |

Daily Oscillators

| Name | Value | Action |

|---|---|---|

| Relative Strength Index (14) | 45.58 | Neutral |

| Stochastic %K (14, 3, 3) | 58.26 | Neutral |

| Commodity Channel Index (20) | 31.37 | Neutral |

| Average Directional Index (14) | 34.72 | Neutral |

| Momentum (10) | 0.90 | Buy |

| MACD Level (12, 26) | -7.18 | Buy |

| Stochastic RSI Fast (3, 3, 14, 14) | 93.12 | Neutral |

| Williams Percent Range (14) | −39.97 | Neutral |

| Ultimate Oscillator (7, 14, 28) | 51.13 | Neutral |

Jio Financial Services Latest News & Events Affecting Share Price

03/06/2025

Jio Financial Services share surges 10% in three consecutive sessions amid reports of the company acquiring SBI’s stake in Jio Payments.

03/04/2025

Jio Financial Services, a subsidiary of Reliance Industries, has announced plans to buy State Bank of India (SBI)’s 17.8% stake in Jio Payments Bank for ₹104.5 crore. The acquisition will make Jio Payments Bank a wholly-owned subsidiary of JIOFIN.

03/03/2025

On March 3, 2025, Jio Financial Services Ltd (JIOFIN) shares declined 4.3% to hit a new 52-week low of ₹198.6 on the NSE. Since its debut in August 2023 at ₹265 per share, the stock has declined nearly 39%.

02/26/2025

Jio Financial Services shares are trading near ₹225.65, with a target of ₹252-255. Long-term investors are advised to buy, especially if shares close above the 20-day moving average of ₹238-240, as it may see a recovery after the recent decline.

02/22/2025

Jio Financial Services will join the Nifty 50 on March 28, 2025, replacing BPCL and Britannia. With its inclusion, the PE ratio of the index may increase by 2.5% from 22.1x to 22.6x.

02/14/2025

Market expert Rachit Khandelwal considers Jio Financial Services a strong investment for the long term. He recommends holding, with a mid-term target of ₹288.

02/13/2025

Jio Financial Services reported a slight increase of 0.32% in consolidated net profit for Q3 FY25, which reached ₹294.78 crore. Revenue increased by 5.98% to ₹438.35 crore. The company has launched its wholly-owned subsidiary Jio BlackRock for broking services.

02/12/2025

K.R. Choksey has given a ‘Hold’ rating to Jio Financial Services, and revised the price target to ₹286 from ₹345 earlier. The brokerage noted concerns over asset quality and valuations.

Jio Financial Services Share Price Target FAQ

What is the Jio Financial Services share price target 2025?

Jio Financial Services share price target for 2025 is between ₹208.50 and ₹331.75.

What is the Jio Financial Services share price target 2030?

Jio Financial Services share price target for 2030 is between ₹687.00 and ₹850.75.

Is it profitable to invest in Jio Financial Services share?

According to our profit calculator, buying Jio Financial Services shares one year ago was not a profitable decision, as the shares have decreased by 32.28%.

What affects the price of Jio Financial Services share?

The price action of Jio Financial Services share is affected by supply and demand in the market. There are many things that affect supply and demand, such as a company’s financial performance (revenue, earnings, and future growth prospects), the overall economy (interest rates, inflation, and GDP growth), industry trends, investor sentiment, and news or events related to the company or its sector. And sometimes global events, political developments, and regulatory changes can also impact and influence share prices.

Risk Disclaimer: Stock prices can be volatile. You should only invest in stocks that you are familiar with and where you understand the associated risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be considered as financial advice. Past performance is not a reliable indicator of future performance. The value of your investment can go down as well as up, and you may not get back the amount you invested. You are solely responsible for your investment decisions. Figw is not responsible for any losses you may incur.