What can we expect from Salasar Techno in the coming years? In this article, we will explore the long-term share price targets for Salasar Techno from 2025 to 2030, along with a detailed analysis of the key factors that could impact its stock performance. As of October 24, 2024, Salasar Techno share is currently trading at ₹17.50 on NSE. Based on our analysis and expert opinions, the Salasar Techno share price target for 2025 is estimated to be around ₹23.75, which is a 35.71% increase from the current price. By 2030, analysts estimate the share price could reach ₹61.75.

Salasar Techno Engineering Ltd. (NSE: SALASAR) Overview

Salasar Techno Engineering Limited is an Indian company that manufactures galvanized steel structures like telecom towers and power transmission line towers. It was started on October 24th, 2001, in Jaipur, Rajasthan, as Salasar Petrochemicals Private Limited, which was changed to Salasar Techno in 2006.

The company has three manufacturing units in Uttar Pradesh, where it does engineering, fabrication, and galvanization. In 2017, it setup its galvanizing plant, merged with Ganges Concast Industries, and launched its public issue through an IPO.

Now Salasar is focusing on renewable energy and heavy steel structures so that 5G and smart city projects can be fulfilled.

Company Information

Company Type: Public

Industry: Engineering – Industrial Equipment

Founded: 2001

Headquarters: New Delhi, India

Key People: Alok Kumar (Chairman & Managing Director)

Products: Telecommunication Towers, Power Transmission Line Towers, Smart Lighting Poles, Monopoles, Guard Rails, Substation Structures, Solar Module Mounting Structures, Customized Steel Structures, etc.

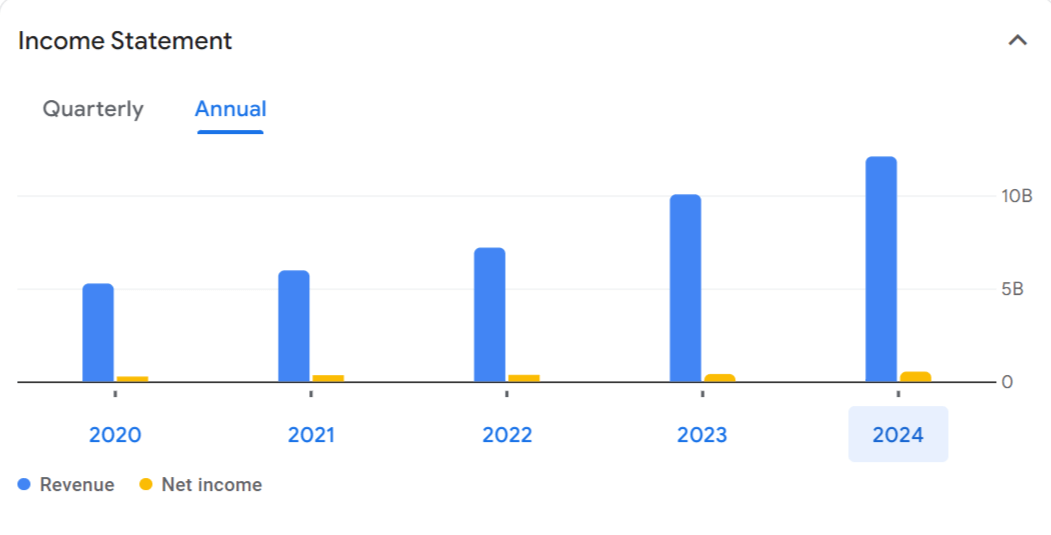

Revenue (2024): ₹1,211.9 crore (FY 2024)

Net Income (2024): ₹52.93 crore (FY 2024)

Visit: salasartechno.com

Salasar Techno Engineering Financial Health and Performance

Before we get into the Salasar Techno share price target 2025 to 2030, we need to look at the financial situation of Salasar Techno. By analyzing both the risks and rewards will help us assess its future performance.

Risks:

- High PE: The PE ratio is 56.36, which is higher than the sector average of 39.75, so stock may be overvalued.

- Decreasing Promoter Holding: Promoter holding decreased by 2.09% in the last quarter to 54.95%, which was a reduction in key stakeholder confidence.

- Promoter Pledges: Promoter pledges increased by 0.08% QoQ to 4.22%, which was an increase in financial stress..

- Falling Cash from Financing: Financing cash flow decreased 57.2% YoY so growth may be limited.

- Decent ROE: ROE is 11.75%, which is lower than industry levels.

Rewards:

- Stable Revenue Growth: Annual revenue grew 20.31% YoY to ₹1,212 Cr, which is higher than the sector’s 11.39%.

- Good Profit Growth: Net profit grew 31.77% to ₹53 Cr, which is higher than the sector’s average profit growth.

- Improved Quarterly Performance: Q2 FY2024 revenue grew 2.7% YoY, and net profit grew 6.0%, which is good operational performance.

- Good Debt Management: Debt to equity is 0.77, which means the company is not heavily debt dependent.

- High Interest Coverage: Interest coverage ratio of 2.88, which was enough to cover interest payments comfortably.

- Strong Operating Cash: Operating cash was ₹52 Cr in FY2024, which was a 31,444.4% YoY increase.

- Good Stock Performance: Stock has given an 88.52% return in the last year, which is 44.19% above the sector.

Overall, Salasar Techno financial health looks good, with consistent revenue and profit growth, manageable debt, and improved cash flow, which indicates positive outlook for the future.

For more better view, check out the charts below, which are annual revenue and profit growth, along with share price changes of the last 5 years.

Salasar Techno Share Price Target 2024 to 2030

| Year | Share Price Target |

| 2024 | ₹20.15 |

| 2025 | ₹23.75 |

| 2026 | ₹29.40 |

| 2027 | ₹38.60 |

| 2028 | ₹45.80 |

| 2029 | ₹52.30 |

| 2030 | ₹61.75 |

Salasar Techno Share Price Target 2024

Salasar Techno share price target could be ₹20.15 by 2024, and this is based on some strong indicators. The Indian government has allocated ₹10 lakh crore (approximately $135 billion) for infrastructure development. The budget has a special focus on power transmission and renewable energy projects. Salasar Techno will benefit from these sectors.

The company has reported 20.31% revenue growth in Q1 FY 2024. As of the end of the first quarter of the financial year 2025, Salasar Techno had an order book of ₹24,019 million, which is a good sign for future projects.

| Month | Share Price Target |

| November 2024 | ₹18.90 |

| December 2024 | ₹20.15 |

Salasar Techno Share Price Target 2025

The expected share price target for Salasar Techno in 2025 is ₹23.75 as Salasar Techno is expanding its capabilities in renewable energy and infrastructure services. As per the Ministry of New and Renewable Energy (MNRE), India has to achieve 500 GW of renewable energy by 2030. This is an opportunity for companies like Salasar Techno.

Salasar Techno has some partnerships and contracts for solar and wind projects, which strengthens their market position. Their EBITDA margin has increased to 11.12% in FY 2023–2024, which improves their cost management and efficiency.

| Month | Share Price Target |

| January 2025 | ₹19.80 |

| February 2025 | ₹20.45 |

| March 2025 | ₹21.70 |

| April 2025 | ₹22.15 |

| May 2025 | ₹21.85 |

| June 2025 | ₹22.40 |

| July 2025 | ₹22.90 |

| August 2025 | ₹23.15 |

| September 2025 | ₹23.45 |

| October 2025 | ₹23.20 |

| November 2025 | ₹23.60 |

| December 2025 | ₹23.75 |

Salasar Techno Share Price Target 2030

By 2030, Salasar Techno share price target is ₹61.75, which is backed by some key trends. The global renewable energy market is expected to grow 8% more from 2021 to 2028. India is moving towards sustainable energy sources, and Salasar will accelerate the growth in solar power.

If the company secures big projects, then both its market share and profitability will grow. Government spending on infrastructure will add to this positive outlook.

| Year | Share Price Target |

| 2030 | ₹61.75 |

Is Salasar Techno good for long-term investment?

Salasar Techno has seen 263.53% growth in the last 3 years, while Nifty Smallcap 100 has seen 66.86% growth. The company’s market cap is ₹3,013.21 crore. In the June 2024 quarter, it made a profit of ₹10.49 crore, which was a 3.47% increase from the same quarter in 2023. The company’s net sales for the quarter were ₹294 crore, a 12.27% increase from the same quarter in 2023.

But there are some challenges. The P/E ratio is 56.36, which is high and indicates overvaluation. The ROE is 11.75%, which is slightly lower than the industry average. And dividend yield is 0.00%, which means no dividend is being given to shareholders.

But still, Salasar Techno has had a revenue growth rate of 13.07% in the last 5 years, which is higher than the industry average of 9.84%. Its market share is also increasing, which shows its strong presence in the steel and infrastructure sectors.

Considering all these factors, Salasar Techno has growth potential. But investors should look into its valuation and profitability before taking long-term investment decisions.

FAQs on Salasar Techno Share Price Target

What is the current share price of Salasar Techno?

As of October 24, 2024, the Salasar Techno share price is ₹17.50.

What is the Salasar Techno share price target 2025?

The Salasar Techno share price target for 2025 is estimated to be ₹23.75, based on current trends and analysis.

What is the Salasar Techno share price target for 2030?

The estimated share price target for Salasar Techno in 2030 is ₹61.75.

What are the key factors that could impact Salasar Techno stock performance?

Key factors include the company high debt-to-EBITDA and low operating profit to interest ratios, promoters stake reduction, sideways technical trends, underperformance compared to historical valuations, government infrastructure spending, renewable energy market trends, competition, and economic policies. Besides, quarterly earnings, product launches, and corporate announcements can also affect the stock.

How can I analyze Salasar Techno Stock?

To analyze Salasar Techno stock, start by researching the company’s financials like revenue, profit margins, debt levels and cash flow. Look into industry trends, competition and any recent news or development that can impact Salasar Techno.

Important links

Important! All price forecasts and predictions are provided for information only and shall not be construed as investment advice. Note that market prices may be affected by unpredictable factors. Forecasts may change based on the current market situation. When planning an investment, figw recommends considering risk management rules.