Tata Power Share Price Target 2025: On June 12, 2025, Geojit BNP Paribas reiterated a Buy rating on Tata Power (NSE: TATAPOWER) stock with a price target of Rs 468 (previously Rs 460), which implies a potential upside of 11.32% from the current level.

Tata Power reported strong performance supported by progress in its renewable energy pipeline, near-full use of its solar manufacturing unit, and its position in rooftop solar and EV charging. It is also working on pumped hydro projects, expansion in clean energy, and upgrades to digital grid systems, which support its long-term plans.

The company has focused on capital discipline, rural electrification, and growth in third-party EPC orders. These factors support the business structure as clean energy demand grows across renewables, storage, and power distribution.

Tata Power aims to commission 2.5 to 2.7 GW of renewable capacity in FY26 and produce over 3.7 GW of solar modules. It is developing hydro projects in Bhutan and has planned FY26 capex of Rs 25,000 crore, mainly for renewables and transmission. In its research note, Geojit BNP Paribas values the company at 10.2x rolled-forward FY27 EV/EBITDA.

In other recent news, Tata Power shares fell about 4.4% between June 11 and 13, dropping from Rs 412 to around Rs 394. The decline followed investor concerns after the Air India crash on June 12, which affected several Tata Group stocks, including Tata Power, despite limited direct financial impact on the company. Around the same time, Tata Power-DDL appointed Dwijadas Basak as its new CEO.

On Friday at 1:40 PM, Tata Power share price was Rs 396.10, down 1.36% from the previous closing.

Is Tata Power a Good Stock to Buy?

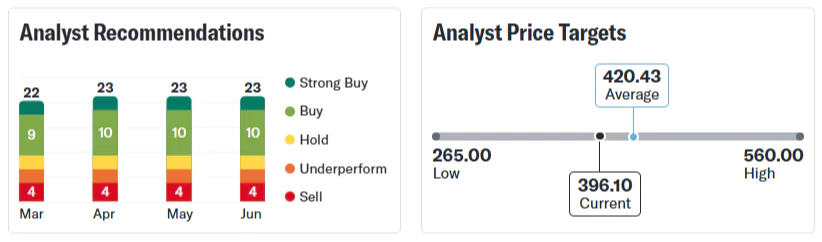

Turning to Wall Street, analysts have a “Buy” consensus rating on Tata Power stock. Based on S&P Global data, the average price target of Rs 420.43 implies an 6.14% upside from the current stock price. Over the past three months, out of 23 analysts covering the stock, 13 have issued Buy, 7 have assigned Sell, and 3 have given Hold, as shown in the graphic below.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on figw.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Figw or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.