Trent Share Price Target 2025 | June 20, 2025 – Trent share price is in the news today. Investors tracking Trent should know that Motilal Oswal has a “BUY” rating on Trent (NSE: TRENT) stock with a price target of Rs 6,900, an upside of 19.44%.

Trent Share Price Today – Friday June 20 2025

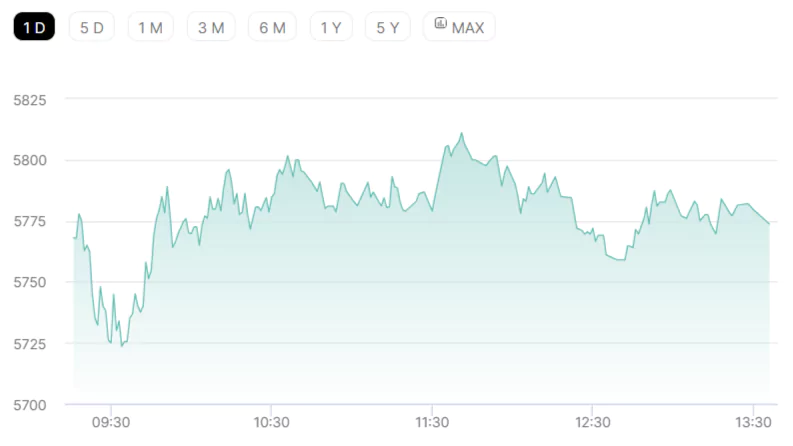

On Friday, June 20, at 1:30 PM, Trent share price was Rs 5,777, up 0.94% from the previous closing. In comparison, the BSE Sensex was up 1.12% at 82269.96. A total of 544,103 shares of the stock traded hands, compared to its average volume of 1,220,555. The company has a market cap of Rs 2.054 trillion and a PE ratio of 132.85.

Latest News about Trent

- Trent shares fell about 1% to Rs 5,693 after earnings, though Macquarie kept its Outperform rating with a target of Rs 7,200, based on a 25% annual sales growth plan through store expansion, entry into adjacent categories, and tighter cost control.

- Morgan Stanley reaffirmed its Overweight rating, calling Trent’s goal of 10× growth by FY2032 credible given its expansion pace and stable profitability.

- Nuvama raised its target to Rs 6,627, citing four growth drivers with Zudio leading, though noting that newer formats like Samoh and Zudio Beauty still need to build margin strength.

Company Financials

For the quarter ended March 31, 2025, Trent reported a Total Income of Rs 4,217 crore, down 9.45% from Rs 4,657 crore in the previous quarter. Compared to the same quarter last year, Total Income was up 27.87% from Rs 3,298 crore. The company reported a Net Profit of Rs 312 crore for the latest quarter.

As of March 31, 2025, Promoters held a 37.01% stake in the company. FIIs held 19.65%, and DIIs held 17.20%. Government held 0.04%, and the Public held 26.08% of the shares.

Trent Share Price Target 2025 – Motilal Oswal

Trent’s revenue grew 6.5x over FY19–25, but its market share in India’s fashion and lifestyle retail is still in the low single digits. The company plans to grow at over 25% a year using a multi-brand, cluster-based model to build presence in key local markets. Management expects this to affect return ratios in the short term, but scale may improve cost efficiency.

In FY24, Trent added 145 Zudio stores, taking the total to over 545, and it plans to add more in FY26. The Star format is present in only 10 cities, with 73% of sales from non-third-party brands. Projections for FY25–27 show 25–26% CAGR in standalone revenue, EBITDA, and PAT.

Motilal Oswal values the standalone business at 55x EV/EBITDA, the Star JV at 2.5x EV/sales, and the Zara JV at 7x EV/EBITDA. The stock is trading at 77x FY27E PE, below its long-term average of about 90x one-year forward PE. Trent| BUY – Motilal Oswal

Trent Share Price Target 2025

Trent Share Price Overview

Trent Share Price Returns

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on figw.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Figw or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.